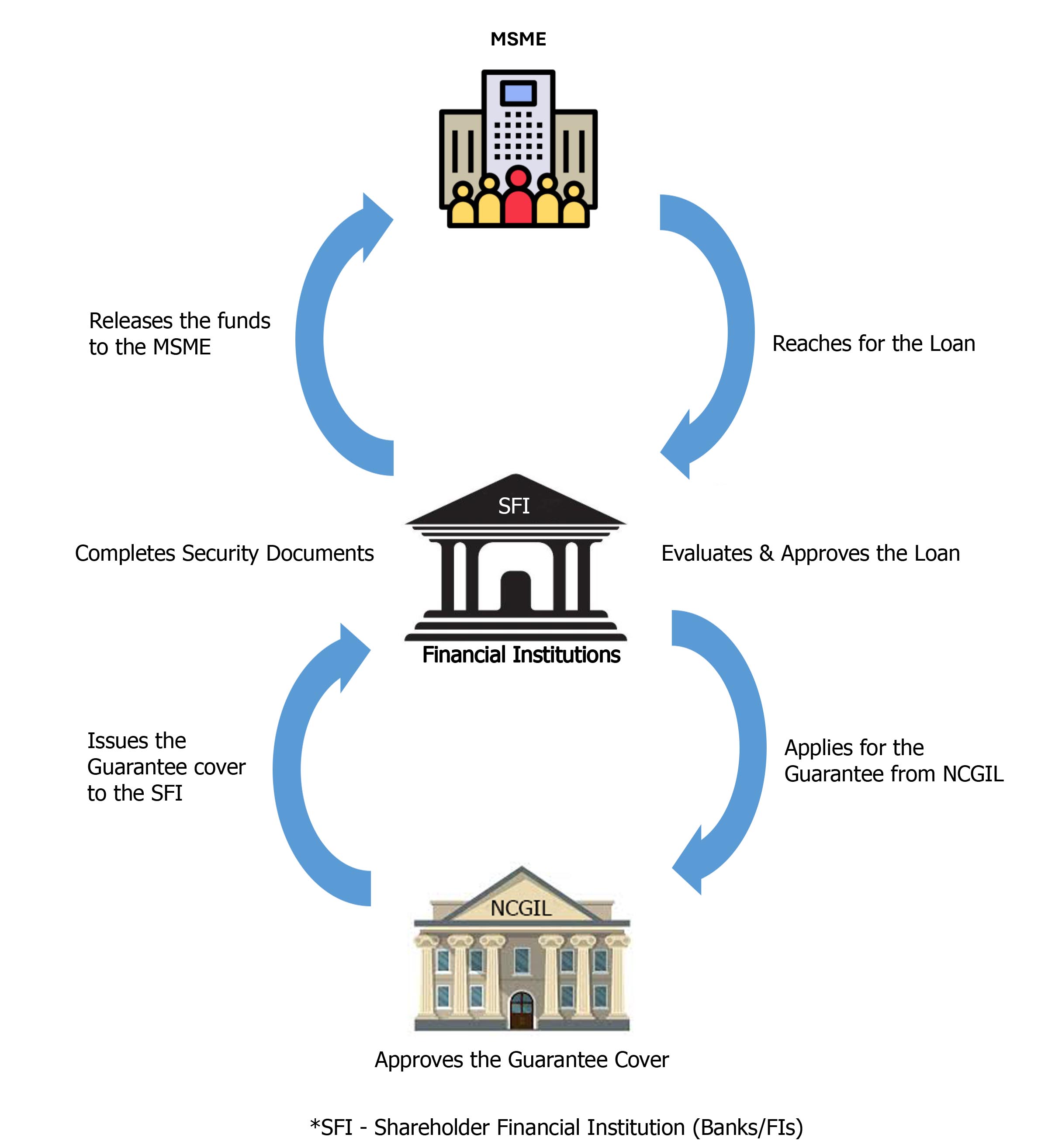

NCGIL Guarantee Administration Process

Eligible MSMEs could approach any of the thirteen shareholder financial institutions (SFI - Bank/FI) under the program, for their funding needs and the SFI will evaluate such proposals to ascertain the overall viability as per their lending guidelines. SFI then approve the loan if the proposal meets all the requirements and thereafter will apply for the guarantee cover from NCGIL. NCGIL will verify the eligibility of the loan approved by the SFI and agree to issue the guarantee cover, if in order, subject to the terms and conditions of the scheme. The NCGIL will charge an annual premium calculated on the guaranteed amount of the loan. The premium charged will range from 1% to 2% PA based on the risk involved in each facility and to be borne by the MSME. With the approlval for the credit guarentee cover by the NGGIL, SFI will arrange to disburse the loan to the MSME.